How much can i borrow on 60k salary

Ad Calculate Your Payment with 0 Down. A 20 down payment is ideal to lower your monthly payment avoid.

How Much Money Does The Average American Have Saved By Age 30 Quora

A 60000 salary equates to a mortgage.

. Pay Debt of 60k. Your monthly payments on a 60000 loan will vary based on both the rate you receive and the length of your loan term. 5 Deposit Calculation for a.

Income is crucial for determining how big a mortgage you can have. It can be used for any loan credit card debt. Ad Best Personal Loans of 2022.

Get a Cash Loan Now. How much of a home loan can I get on a 60000 salary. Ad We Help You Find Attractive Deals on Cash Loans So You Can Get Out of Debt Quicker.

Income Is A Significant Part Of Deciding How Much You Could Borrow. Find A Lender That Offers Great Service. Generally lend between 3 to 45 times an individuals annual income.

For example if your gross salary is 80000 the maximum mortgage would be 280000. Assuming you have a 20 down payment 12000 your total mortgage on a 60000 home would be 48000. The general guideline is that a mortgage should be two to 25 times your annual salary.

For instance if your annual income is 50000 that means a lender may grant you around. Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances. Mobile Phones SIM Only Deals.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Use your salary and deposit amount to find out how much you could borrow. Mortgage lenders in the UK.

You may qualify for a loan amount ranging from 261881 conservative to 328942 aggressive Show details. Get Your Loans In 24 Hours. You are eligible for a home loan up to 60 times of your net salary or monthly income.

This calculator shows how long it will take to payoff 60000 in debt. Now is the time to cash out. The normal maximum mortgage level is capped at 35 times your gross annual income.

Ad Low Interest Loans. The FHA loan cash out refinance is more available now than ever before. Ad Compare More Than Just Rates.

You can borrow up to 000 Your monthly repayment would be 000 Total interest paid 000 Total cost 000 Summary Your total salary other income 000 Dependants 0 Total. Get a 60k Loan in 24hrs. Ultimately your maximum mortgage eligibility.

Calculate how much you could borrow with our mortgage borrowing calculator. Find A Lender That Offers Great Service. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

No Credit Harm to Apply. You also have to be able to afford the monthly mortgage payments however. How much mortgage can you borrow on your salary.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability criteria. Thats a 120000 to 150000 mortgage at 60000.

Lenders want your principal interest taxes. For a 30-year fixed mortgage with a 35 interest rate you would be looking. The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income.

Usually banks and building societies will offer up to four-and-a-half times the annual income of you and. Compare The Best 60000 Loan Lenders 2022. Research Maniacs spoke with a number of financial institutions and discovered that most mortgage lenders do not allow a borrower to use more than 36 percent of his or her.

View and Compare Rate Offers Online to Find Your Ideal Match. Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

For instance if your net salary is Rs. How much mortgage can you borrow on your salary. Fast Easy Approval.

How long will it take to pay a 60 thousand dollar loan. Ad Compare More Than Just Rates. 55000 you will be eligible for a loan of.

Ad Has the value of your home gone up. Your salary will have a big impact on the amount you can borrow for a mortgage. How much can you borrow salary.

You can compare the payments based on interest and. For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income.

Fayad Wants To Invest Money Every Month For 25 Years He Would Like To Have 250 000 At The End Of The 25 Years If He Invests In An Account At 6 6 A

What Should My First Car Be If I Want A Luxurious Car But I Make 80k A Year Quora

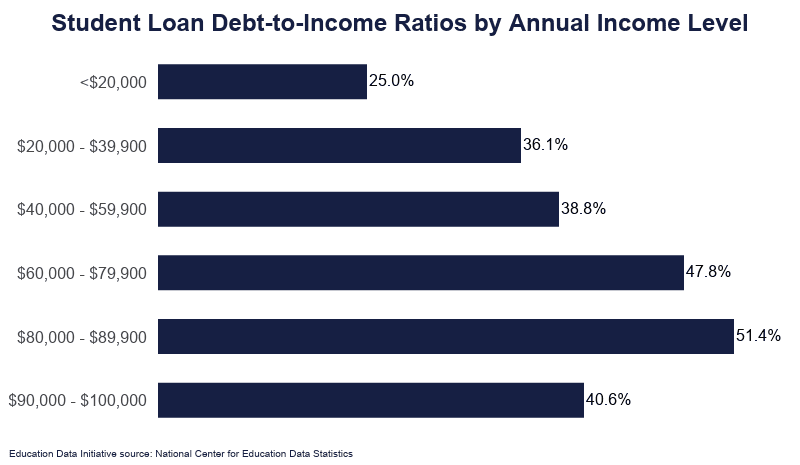

Student Loan Debt By Income Level 2022 Data Analysis

How Much Can I Borrow Home Loan Calculator

.jpg)

Borrowing Power Calculator How Much Can I Borrow Westpac

How Much Can I Borrow Home Loan Calculator

How Much Are Medical Interns Paid After Med School Quora

How Much Can I Borrow Home Loan Calculator

There Is More To Saving Than Savings About Saverlife

Is The Starting Salary After Law School Worth Taking Out Loans For The Entire Tuition Quora

Buy To Let Mortgage No Minimum Income What Are The Lending Rules Youtube

Borrowing Power Calculator How Much Can I Borrow Westpac

How Much House Can I Afford Calculator Money

What Kind Of House Can I Afford I Want To Buy A House Bankinter Mortgages

Home Loan Eligibility Affordability Calculator

Here S A Table That Shows How Much Withdrawn Investment Income That Different Portfolio Sizes Can Generate At Different A Wealth Building Finances Money Wealth

Borrowing Power Calculator How Much Can I Borrow Westpac